Palladium itself has been used as a precious metal in jewelry since 1939, as an alternative to platinum or white gold. This is due to its naturally white properties, giving it no need for rhodium plating. It is slightly whiter, much lighter and about 12% harder than platinum. Palladium is one of the three most popular metals used to make white gold alloys. When platinum was declared a strategic government resource during World War II, many jewelry bands were made out of palladium.

As recently as September 2001, palladium was more expensive than platinum and rarely used in jewelry also due to the technical obstacle of casting. However the casting problem has been resolved and its use in jewelry has increased because of a large spike in the price of platinum and a drop in the price of palladium.

Prior to 2004, the principal use of palladium in jewelry was as an alloy in the manufacture of white gold jewelry, but, beginning early in 2004 when gold and platinum prices began to rise steeply, Chinese jewelers began fabricating significant volumes of palladium jewelry. Johnson Matthey estimated that in 2004, with the introduction of palladium jewelry in China, demand for palladium for jewelry fabrication was 920,000 ounces, or approximately 14% of the total palladium demand for 2004 — an increase of almost 700,000 ounces from the previous year. This growth continued during 2005, with estimated worldwide jewelry demand for palladium of about 1.4 million ounces, or almost 21% of net palladium supply, again with most of the demand centered in China.

The popularity of palladium jewelry is expected to grow ahead as the world’s biggest producers embark on a joint marketing effort to promote palladium jewelry worldwide.

Why Invest in Palladium

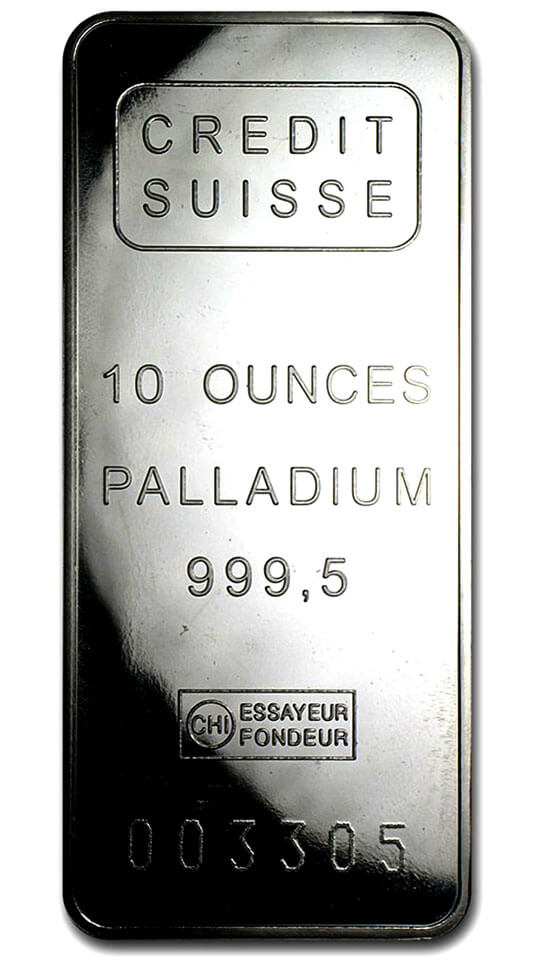

Precious metals offer the investor the opportunity to possess real physical metal in the form of bullion bars or rounds. Bullion is readily available as the precious metals of gold, silver, platinum, and now, palladium. The purchase price of bullion from reputable dealers is normally on a spot plus basis, that is, the current market spot price of the metal plus the dealer markup or transaction fee. When the investor wishes to sell the bullion, the bullion dealer will purchase it back, again at spot.

A transaction fee may apply. Palladium bullion is readily available for purchase from many online sources. Ownership of palladium offers similar investment opportunities as the better-known gold or silver. Palladium, like all platinum group elements, has been used since ancient times, because it is evidence that the ancient Egyptians and pre-Columbian civilizations already valued as a precious metal. The conquerors of the New World rediscovered platinum ore in the seventeenth century, in search of gold.